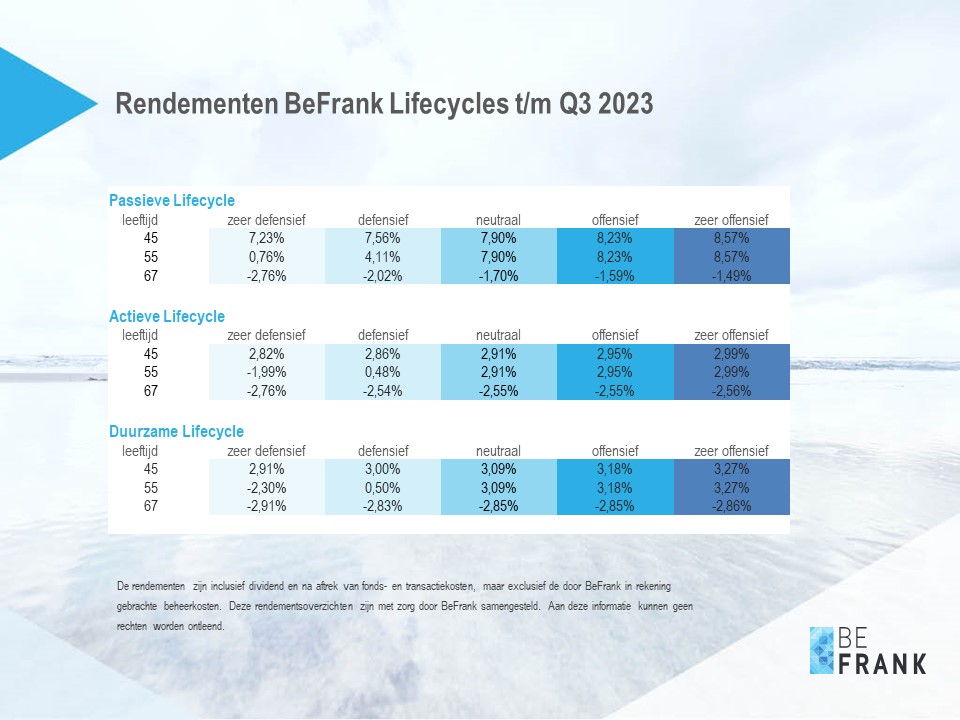

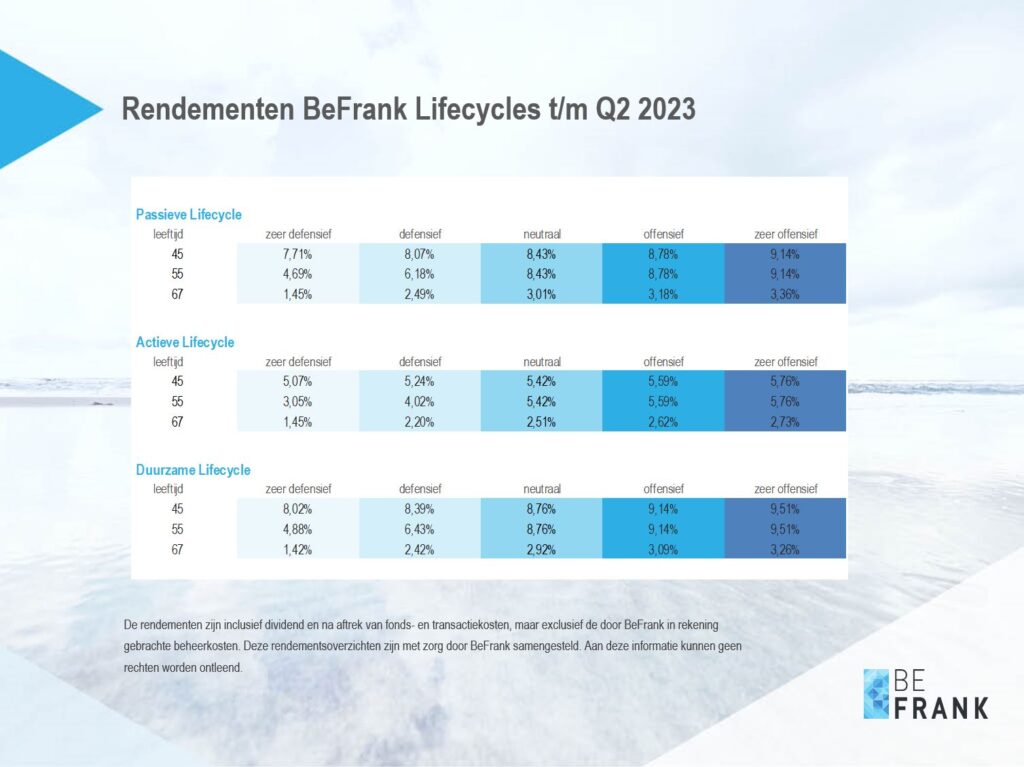

BeFrank’s portfolio comprises investment funds associated with the Passive, Active and Sustainable Lifecycles. These funds are distributed across various regions and categories. When it comes to investing, we always strive to create the best balance between risk and return. This page gives a summary of current returns and returns in previous quarters and years.

Our lifecycles:

- The Passive Lifecycle contains investment strategies from various providers. The aim is to follow the market as efficiently as possible.

- In the Active Lifecycle, we invest in various actively managed investment strategies from NN Investment Partners.

- The Sustainable Lifecycle consists of Triodos funds with a positive impact on the environment and society based on impact investing.

Current returns

You can also watch this video about the developments in the financial markets past quarter.

A detailed lifecycle-specific report of Q4 you can find below:

Returns in previous quarters

Returns in previous years

2021

2020

2019

2018

2017